Buying Down Your Rate Could Save You Up To $45k: Update 4

Looking to make your monthly payment more affordable while interest rates are rising? Consider buying down your interest rate!

Now is still a good time to buy and sell! While rates remain higher than they were during historical lows, they’ve been trending down and are expected to continue this trajectory over the couple next years.

In the past, when rates were climbing, many buyers expressed concerns about affordability. While paying in cash sidesteps interest rate considerations, financing can significantly influence decision-making. If you have good credit and some savings, you have options to make homeownership more attainable, even in a higher-rate environment! One of the most effective strategies is to buy-down your rate, either temporary or permanent.

A temporary buy-down lowers your interest rate for a set period, reducing your monthly payments initially before the rate adjusts back to the standard note rate. The funds for this buy-down are collected at closing, placed into an escrow account, and paid to the lender to cover the difference. For example, with a 2-1 buy-down, your rate might start at 5.75% for the first year, increase to 6.00% in the second year, and settle at 6.25% for years 3-30.

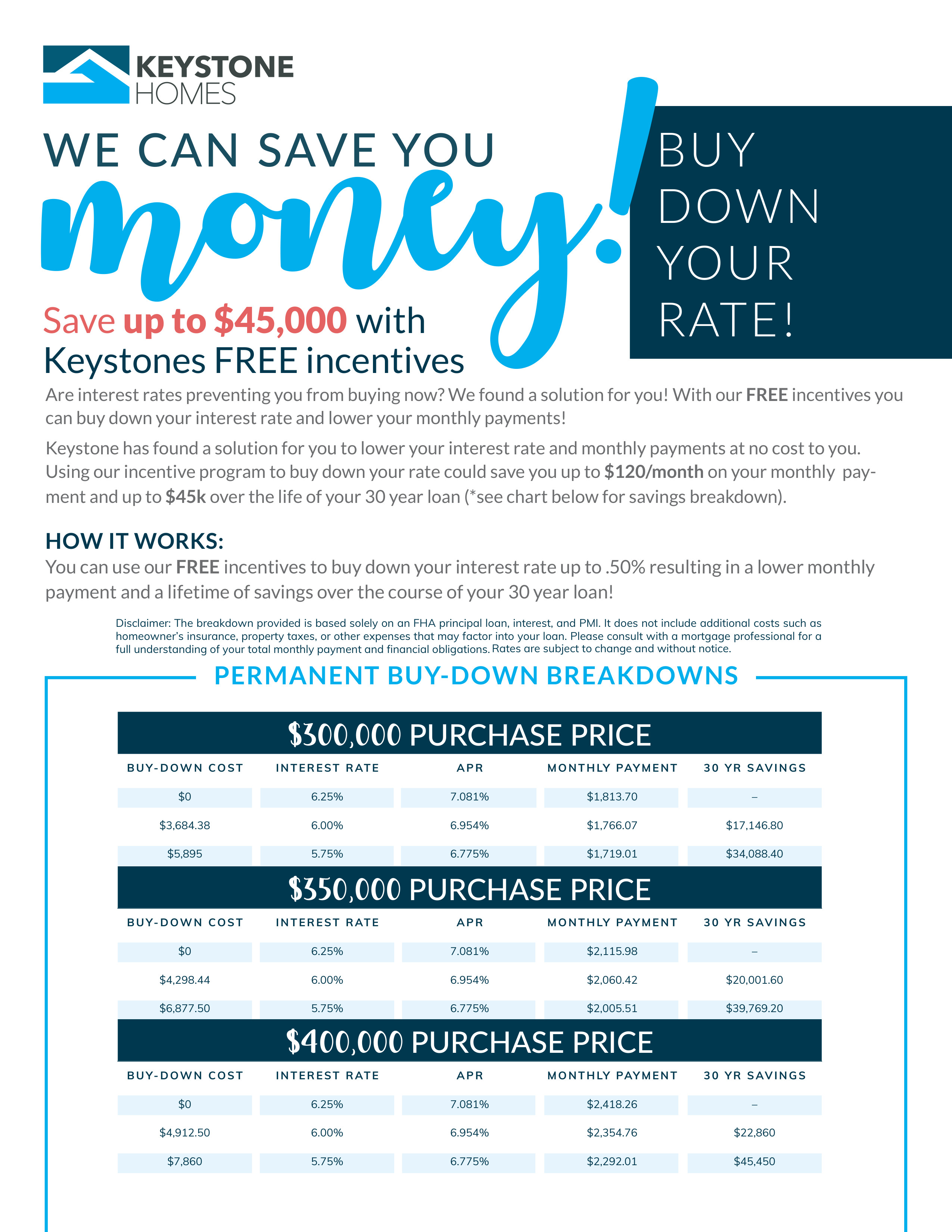

A permanent buy-down, on the other hand, reduces your rate for the life of the loan by paying discount points upfront. While this option requires a higher upfront cost, it offers significant long-term savings, making it an excellent choice for those planning to stay in their home for many years.

Permanent buy-downs can save you up to $120/month on your payments and as much as $45,000 over the life of a 30-year loan. Your savings will vary based on current rates, loan type, credit score, and other factors, but it’s worth exploring how this strategy could work for you.

Even in a higher-rate environment, opportunities exist to make homeownership more affordable and sustainable. Explore the options available to you and take advantage of the tools designed to fit your needs.

Alan Rabun, Producing Production Manager at BankSouth Mortgage in Augusta, GA, provided information on how buy-downs work and how they can benefit you in the breakdown below. Keep in mind, that this information may vary based on interest rates at the time of your application, loan type, and your individual circumstances, including credit score and credit history.

Disclaimer: The breakdown provided is based solely on an FHA principal loan, interest, and PMI. It does not include additional costs such as homeowner's insurance, property taxes, or other expenses that may factor into your loan. Please consult with a mortgage professional for a full understanding of your total monthly payment and financial obligations. Rates are subject to change and without notice.

If you’re looking to make your monthly payment more affordable while interest rates are higher, consider buying down your interest rate, temporarily or permanently, or refinancing in 6 months to a year. Keep in mind, that eligibility may vary based on the individual’s circumstance and the lender they’re using. We highly recommend you chat with a lender as early in the home-buying process as possible.

For more information on buying down your interest rate, click here.

Keep a lookout for our next keynote (blog), where we discuss refinancing and how this may be an option for you.

Featured Stories

Contact Us Today

It's more than just a house, it's your home.

Schedule Your AppointmentSIGN UP FOR OUR NEWSLETTER AND STAY UP TO DATE!

Start the Process!

Complete the form to receive more information!

We want to hear from you. If you need to contact Keystone Homes or have comments and suggestions about our new website, we would love to hear from you. Please call us at the numbers shown or contact us online by completing and submitting the form below. We will promptly reply with an answer or direct you to your answer. We're glad you took the time to visit this site and we hope you are finding it useful and informative.